Ever since traveling to England, I’ve been somewhat curious about the options that other countries offer for retirement savings.

Ever since traveling to England, I’ve been somewhat curious about the options that other countries offer for retirement savings.

I know we talk an awful lot on here about plans that are available in the U.S. like IRA’s, 401k’s, etc. So today we’re going to jump across the pond and take a look at what folks in England have to supplement their retirement savings. In particular, we’re going to talk about the ISA or Individual Savings Account.

An ISA is very similar to Roth IRA here in the U.S. You fund (or “subscribe”) money to the account with post-tax sources, the money grows tax free, and no taxes are paid at the time of withdrawal. However unlike American IRA’s, there are no limits or restrictions as to when or how much money can be taken out.

There are basically two types of accounts:

The Cash ISA:

A Cash ISA is a British tax free savings account that is held in … cash! Think of it just like a regular savings account, only the interest you accumulate is tax is not taxed. And good thing – government taxes can be anywhere from 20% to 50% on the interest you earn. Anyone age 16 and over can invest in a Cash ISA. There is also an option for children to join in a Junior ISA.

Stocks and Shares ISA:

The Stocks and Shares ISA is what you and I (in the U.S.) would think of more like an IRA or 401k. It contains share-based investments and shares in individual companies. These investments may be in what’s called a self-select ISA (which are usually managed by stockbrokers) or collectively in pooled investment vehicles like unit or investment trusts. Anyone age 18 and over can invest in a Stocks and Shares ISA.

How Much Can I Put in an ISA?

Unlike an IRA, there are certain limits on how much money you can put into each type of ISA.

A) You could invest it all in the Stocks & Shares

B) You can combine your investments over the two types of accounts, but you can’t put more than half the amount in the Cash ISA

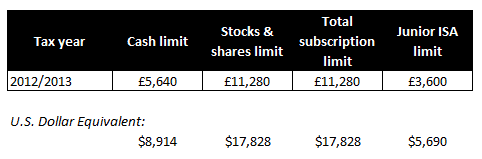

Here is a summary of the 2012-2013 ISA limits:

In addition to deciding on which type of ISA to fund, another important consideration to make in reducing your tax burden is to see if offshore tax planning fits into your situation. After speaking with a consultant, you possibly may find it beneficial to live abroad temporarily.

Images courtesy of FreeDigitalPhotos.net

Leave a Reply